Is Netflix Ready To Rally To New Highs?

With earnings this week, has chart sentiment bottomed for a turn around?

Netflix NFLX 0.07%↑ has not been on a kind ride for longs since June. With the continued selloff since the summer and earnings this week, the stock is more than likely setting up to begin a bounce, but there’s a good possibility it’s only the second leg of the three-leg corrective structure. Confirmation of the structure will guide us, and earnings could provide insight and bring the price structure we need to determine which path.

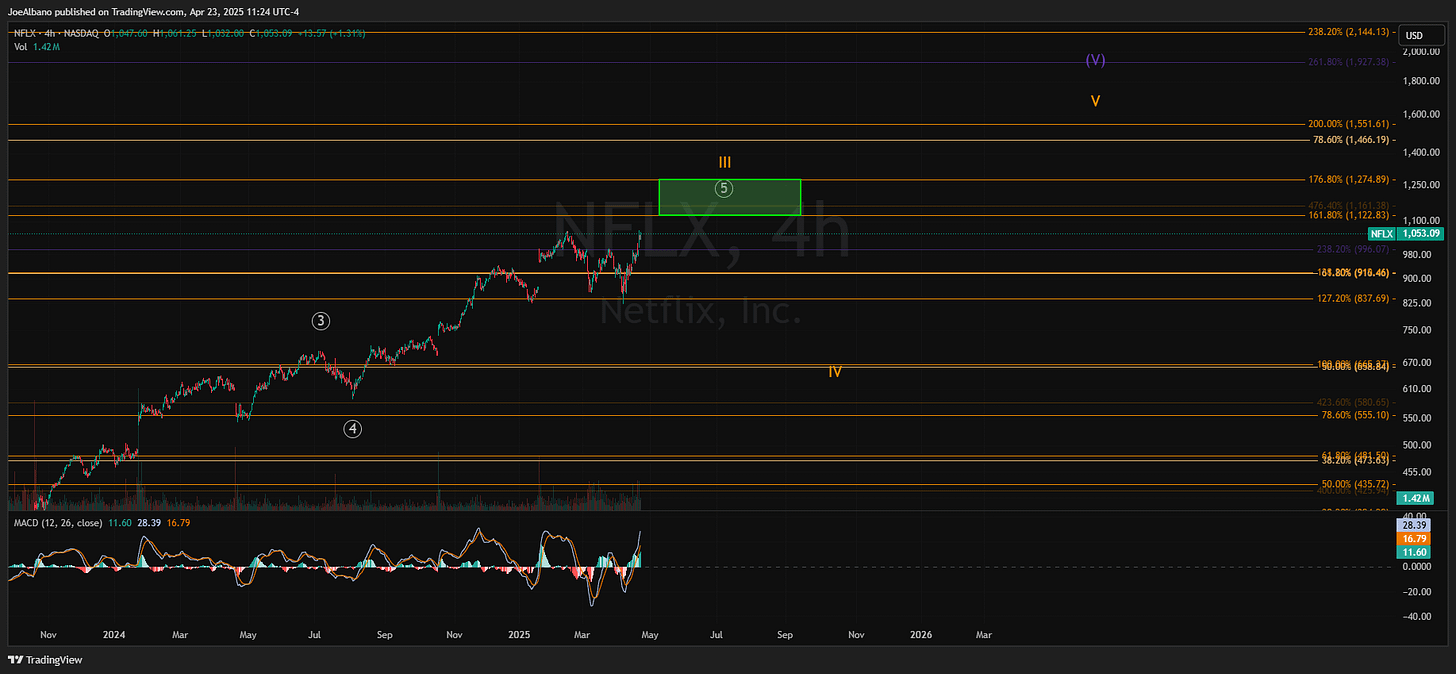

In April, I outlined the target the stock would hit during the summer in the larger third wave. I added it would then reverse in a corrective fourth wave. Here’s the structure I showed in April before it played out:

Since then, it has played out almost exactly. The only difference was the moving of circle 3 and circle 4 to their appropriate spots after seeing the poke above the target zone, which showed its own wave structure at that same degree.

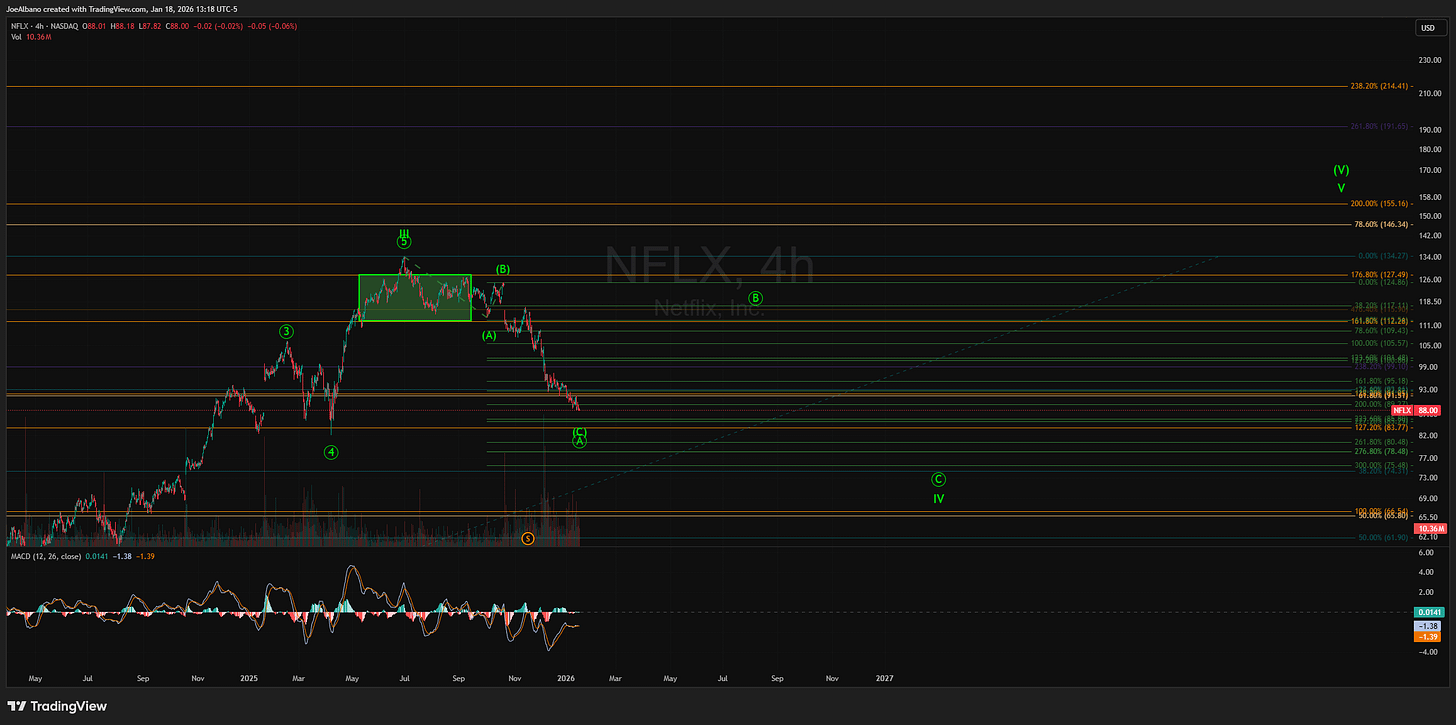

The question now is whether wave IV is complete or if it’ll continue to carry on with wave circle B and circle C. So far, the speed of the move has quickened the structure is to the point where much of the move could already be completed. In fact, I had expected a bit more of a drawn-out structure with (A) of circle A only completing around the high $90s. With the move into the $80s, the stock could be completing a more direct move to circle A, with potential to be all of IV.

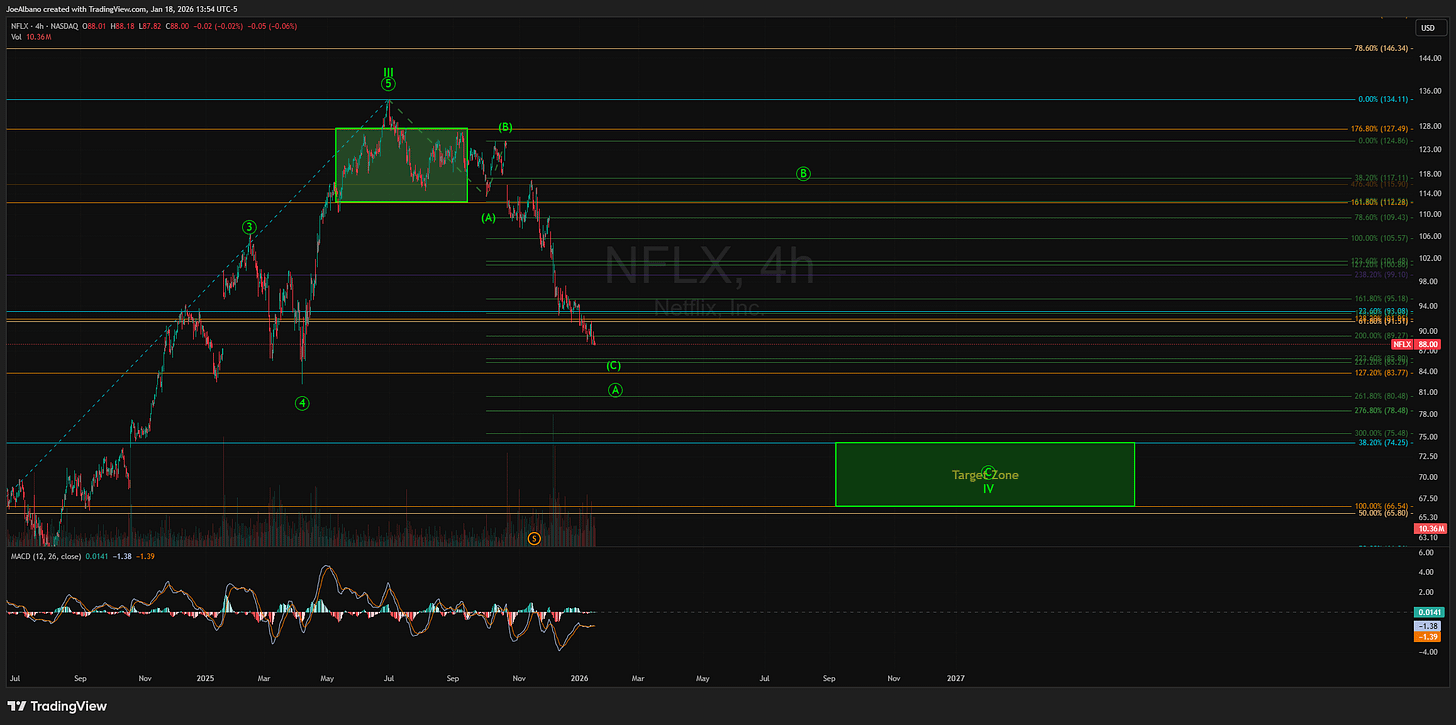

But it hasn’t hit my targets yet of either the 38.2% retrace of the third wave or the 100% extension of the larger I-II move. Those two levels are at $74.25 down to $66.54. This is why I expect there is still a larger correction taking place with the circle A, circle B, and circle C, which would get it to the 38.2% retrace near $74.

The key for me to determine if IV is complete or not is to see if we get three waves up, which would be circle B, or if we get five waves up with a three-wave pullback. Earnings should provide a bounce of some sort, which can aid in knowing (as long as it isn’t a huge gap up). The less likely path is a continued move down, as it has, which would have me thinking this entire wave IV is completing directly, which is not common, but an option.

Brillant setup here. The three-leg correction with targets at the 38.2% retrace makes way more sense than calling a bottom too early, and I dunno if most folks notice those retrace levels line up like that. Last time I waited for a similar wave structure on tech stocks it really paid off once confirmation hit.