Micron Minute: Memory Chip Glory Has Arrived, But What About Micron's Stock?

Micron just posted a historic beat and guide, but the stock’s reaction suggests sentiment may already be turning

Wow.

Have you seen a better earnings report and guidance raise? Even Nvidia NVDA 0.00%↑ would take notice of what Micron MU 0.00%↑ delivered on Wednesday afternoon.

You know something else Micron didn’t do? Preannounce.

For the first time, with a hefty beat of its own guidance, it didn’t preannounce.

Yet, the stock isn’t that all entertained.

Yes, it was up 7% after hours, but that brought it all the way back to Monday’s price - two days prior.

While I’m going to dive into Micron’s report and guide much deeper in next week’s Tech Ideas for paid subscribers, I want to focus more on what’s going on with the stock after the historic beat and raise.

When a company, particularly Micron, issues guidance for nearly double what Wall Street was estimating and the stock doesn’t budge much, it gets you thinking.

For me, I was looking at the chart on Wednesday afternoon ahead of the report and contemplating some final thoughts on the different scenarios and paths the stock could take under Elliott Wave Theory post earnings.

Founding Tier members were able to get my thoughts in real-time in Tech Cache’s chat:

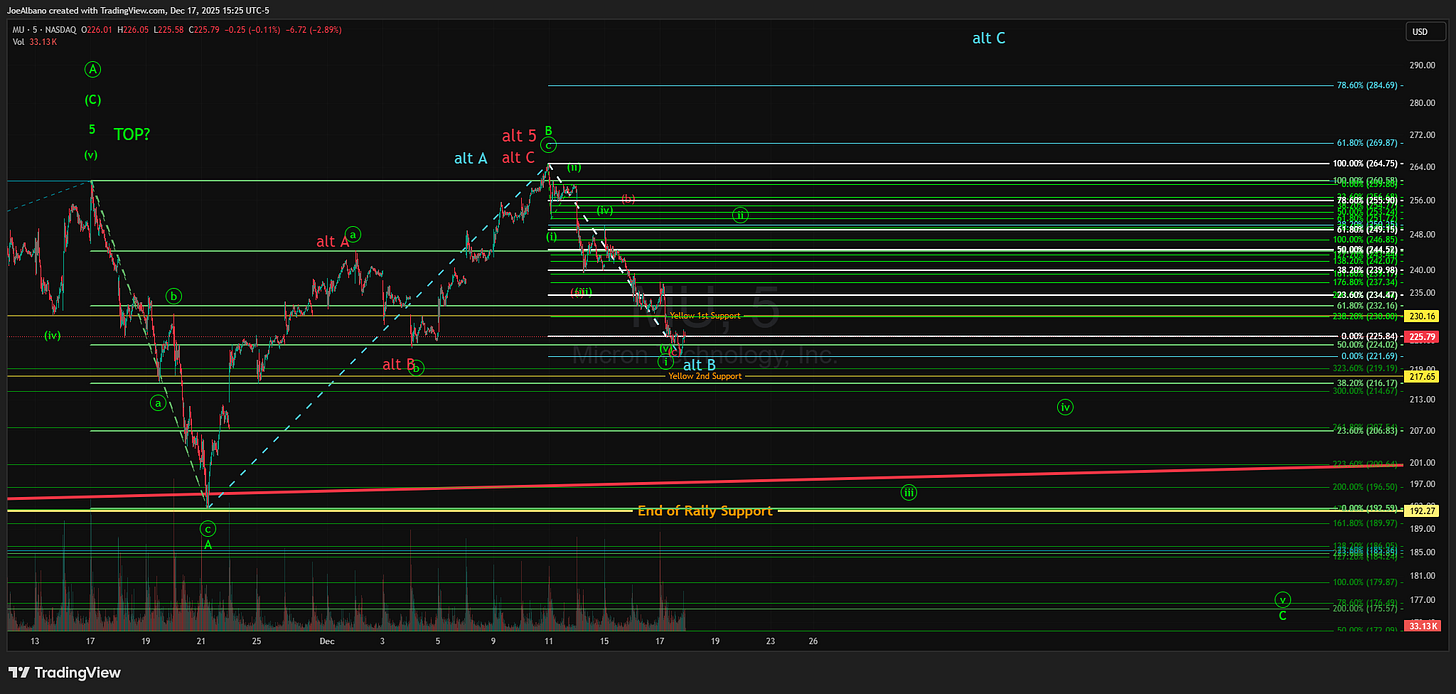

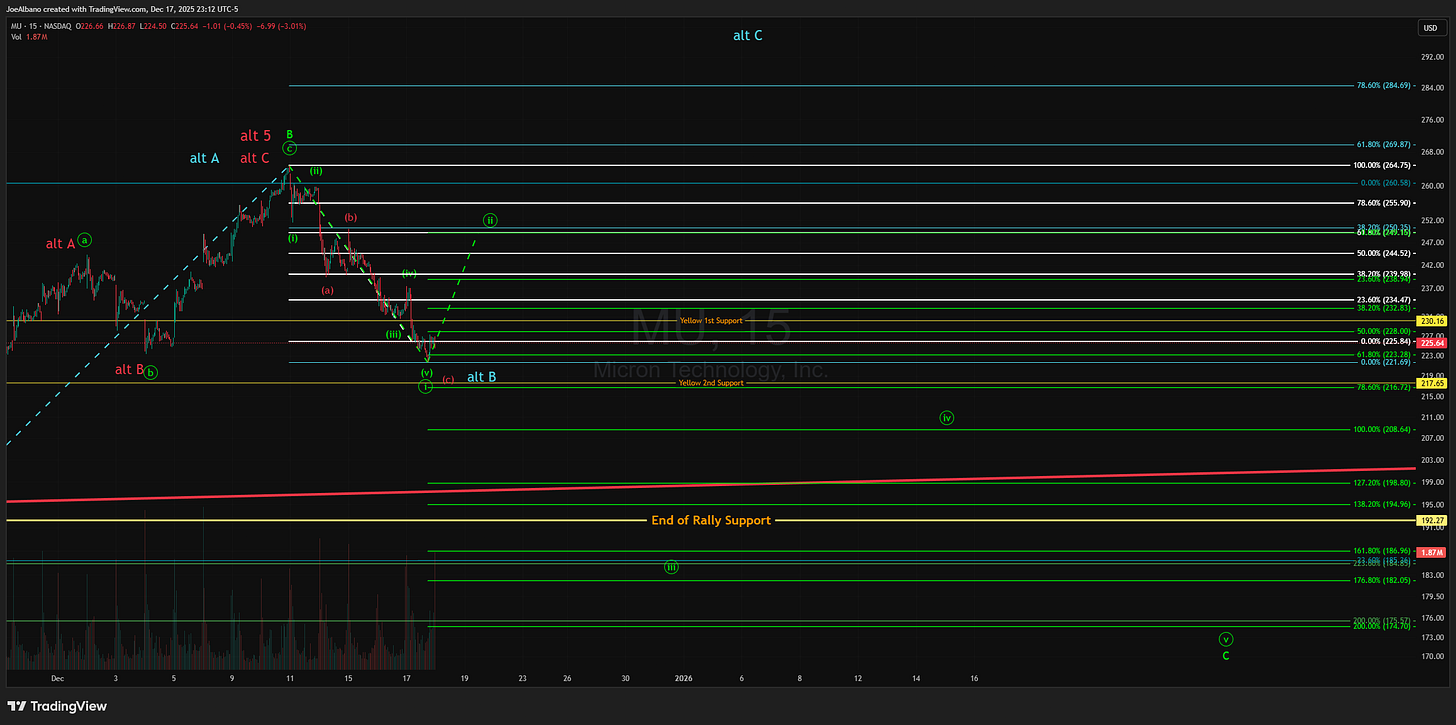

I then followed it up with the chart I landed on, changing the path of the red count to completed and missing upside targets, and adding the teal count. The green count wasn’t touched.

What I determined was Micron was likely in an expanded B wave pattern in green, as we saw the stock rally in three waves off the yellow support line from late November and reverse with what is potentially five waves down. Alternatively, we were in a much larger A-B-C pattern for a rally to the final high in teal (unorthodox and a tricky pattern to follow if it did play out).

Either way, I saw a bounce happening under either circumstance, and is how I concluded - and then shared - Micron would bounce after earnings.

For teal to be the real deal, it would have to break $249, which is the 61.8% retrace of green circle i. Above that, and teal gains in probability. But below it and green remains front and center, and yes, it would mean a drop back to lows into the $190s.

Hold up.

At this point, you’re yelling at your screen or shaking your head, “Joe, you saw the report and guide, right? Wait, I know you did, your first sentence was ‘Wow!’”

Yes, but you must remember, you’re reading the guy who doesn’t take fundamentals for granted. As I posted in a note yesterday morning, after entertaining comments on an Nvidia article I posted on Seeking Alpha, a stock and a company are not the same thing.

Basically, a company and its business are rooted in fundamentals; a stock and its chart are rooted in sentiment. One is not the other. Just because a company performs well doesn’t mean its stock will reflect that. And the piece we are able to profit from is the stock, not the business. Thus, I follow where the stock is going.

That doesn’t mean the fundamentals are thrown out; after all, a company going bankrupt most likely won’t see favorable returns, but stock sentiment could do strange things. Similarly, a company putting out a stellar report and guide could see its stock sink. We’ve seen this with Nvidia and, more recently, BroadcomAVGO 0.00%↑. This is due to the fact sentiment was already in an upcycle going into their reports and peaked before the numbers were ever published.

With my philosophy in mind now, it wasn’t strange for me to see Micron’s stock only move up 7% after hours, right to the point I called out (notated by circle ii in green) to my paid subscribers before the report. For such a huge beat and raise, it should have made new highs.

“Should have.”

That’s the part getting everyone. Should have and have are not the same.

What I’ve outlined in green is saying Micron’s sentiment peaked last week and has since reversed. The move we saw after hours on Wednesday indicated that reversal is still in play. Unless the stock breaks $264.75 (and by the time you read this, that could be the case), the green count is more probable. Under $249, green is highly likely.

What I’m saying is, don’t be surprised Micron gaps up to $249 on Thursday morning and reverses and turns out red on the day. If that happens, and if the stock winds up putting a lower low in below Wednesday’s lows, the odds Micron stock is headed to the $170s over the next few weeks are highly likely.

Shocking, I know.

Now, of course, I need an alternative if things do rally on Thursday. So, if we break out and move above and beyond the $256 area, the teal count becomes more probable. Above the prior high of $264.75, and it targets $284-$205. Keep in mind, though, even with the teal count, I don’t have a count that sets us up for a meaningfully higher high after that. The fact the teal count is a three-wave rally structure in and of itself means it’s the signal of the end of a rally.

Remember, this isn’t a heads I win, tails you lose in terms of me giving you more than one chart outcome. The idea is there are levels on the chart which flip the odds from bear to bull and bull to bear. The idea is that I can provide the highest probable paths out of the infinite possibilities of a market.

For now, let’s see what this week brings us. Next week, I’ll analyze the quarter and guide with some of my “gotchas” and provide an updated chart analysis once we have the decision likely made by then on which chart count it takes.

Teal is making itself known here today. Green is going to have a difficult time pulling the tug-of-war rope.