Broadcom's Earnings Slow In The Face Of Ramping AI Sales Elsewhere

Not everything has to be about AI, nor should it. But when one of the major semiconductors like Broadcom AVGO 0.00%↑ isn't seeing more than four or five percent growth in its revenues, it makes you wonder how much AI impacts its products. In fact, its enterprise software division is where half its growth came from in its just-reported quarter. What gives if the company supposedly plays no small role in the AI hardware industry?

Broadcom is a cash flow machine; it's the reason it's one of my top IRA holdings. It has a steady long-term place in my retirement account between its dividend and share repurchase program. But when semiconductor growth is slowing to near zero during one of the largest boons to semiconductors in a generation, it makes one scratch their head, wondering where the growth is.

Perhaps its products don't play as pivotal a role in AI as first thought, or the non-AI portion of the business is producing a heftier headwind than anticipated. Either way, the company's just above in-line report and in-line guidance don't give me the bullish warm and fuzzies.

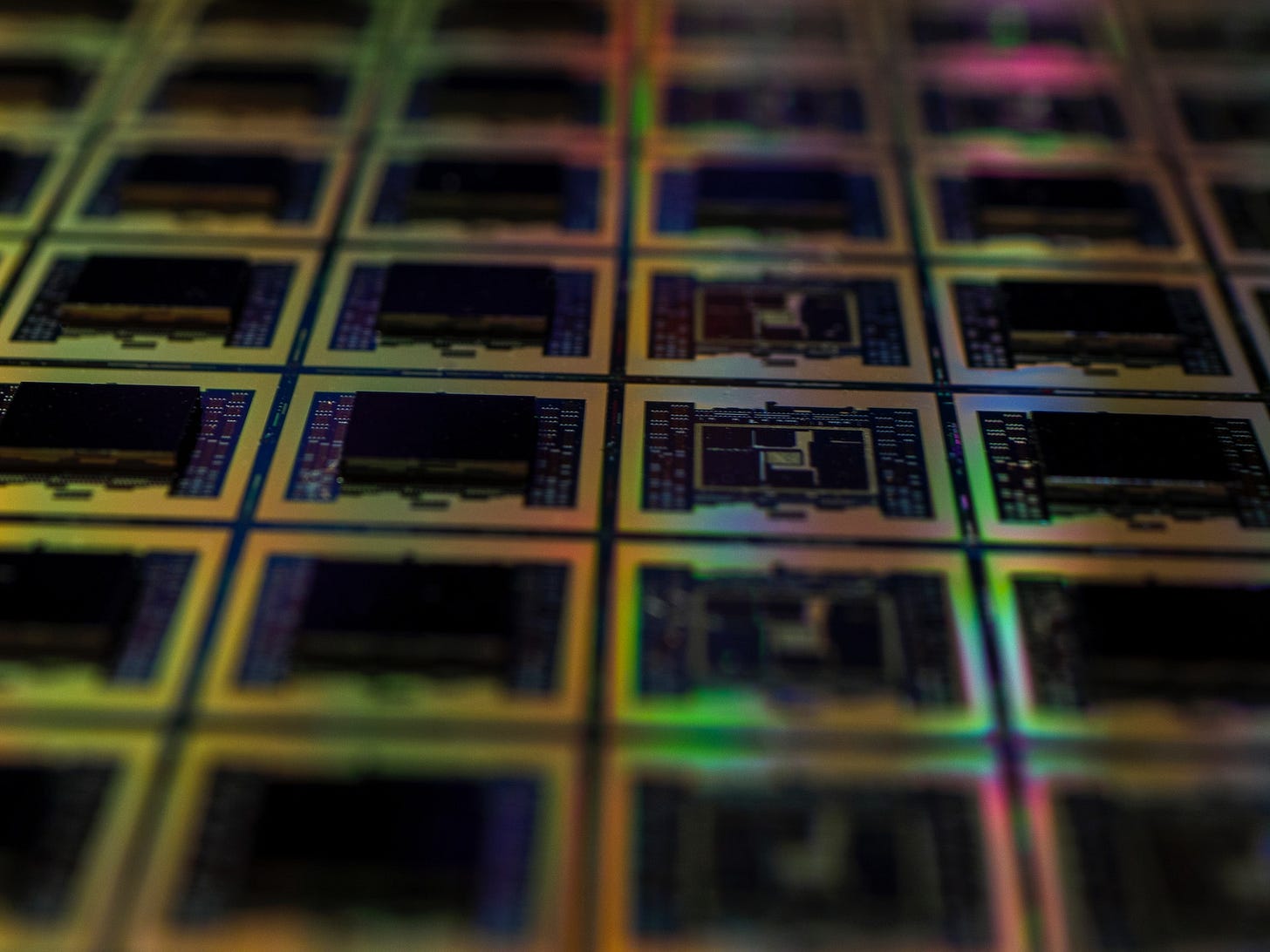

The Semiconductor division is where the majority - if not all - of AI-related business for Broadcom would be taking place. That's not to say its Enterprise Software division doesn't deal with AI software at some level, but hardware is the leading component in the AI world; thus, its semiconductor business is my primary focus.

While Nvidia NVDA 0.00%↑ and some other companies, like Dell DELL 0.00%↑ and Super Micro Computer SMCI 0.00%↑, are seeing meaningful increases in revenue growth, Broadcom's semiconductor growth has moderated quite a bit in the single digits after soaring this time last year.